9297441323 Must-Have Stocks for Long-Term Income

The landscape of long-term income investment is increasingly shaped by must-have stocks that combine reliable dividends with robust growth potential. Investors should analyze companies with a proven history of consistent payouts and innovative strategies that align with market trends. Understanding the interplay of dividend stability and capital appreciation is critical. What specific stocks exemplify these qualities, and how can they fit into a diversified portfolio?

Top Dividend Stocks to Consider

As investors seek reliable sources of income, identifying top dividend stocks becomes essential for long-term financial strategies.

High yield dividend stocks offer attractive returns, particularly when combined with dividend reinvestment plans. These investments not only provide immediate cash flow but also enhance compounding growth over time.

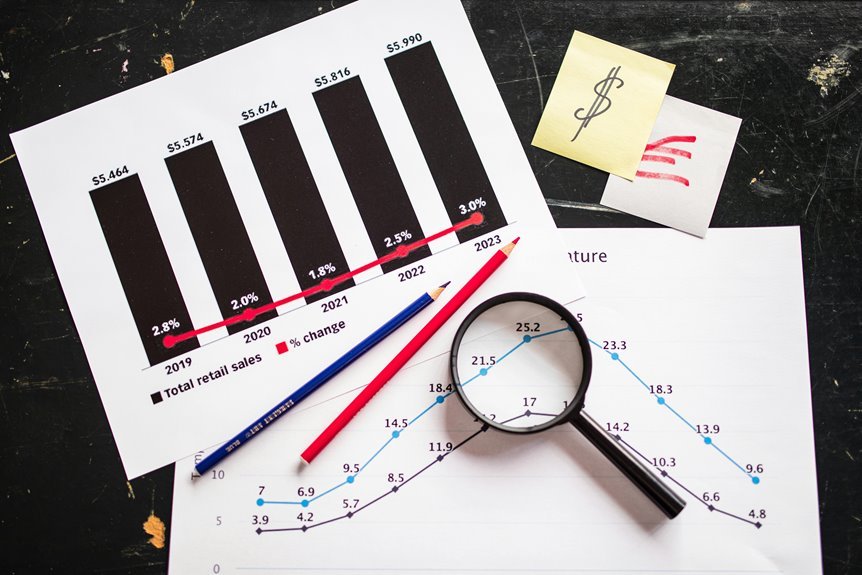

Careful analysis of payout ratios and historical performance can help investors select stocks that align with their financial goals.

Growth Potential of Must-Have Stocks

While dividend stocks are often lauded for their income potential, their growth prospects are equally crucial for investors focused on long-term wealth accumulation.

Identifying growth drivers such as innovative technology, expanding market trends, and strategic mergers can enhance a stock's value over time.

Investors should analyze these factors to ensure their portfolios not only generate income but also appreciate in value, providing true financial freedom.

Strategies for Building a Long-Term Income Portfolio

Building a long-term income portfolio requires a strategic approach that balances risk and return while prioritizing consistent cash flow.

Investors should consider dividend reinvestment strategies to enhance capital growth, thereby increasing future income potential.

Effective risk management is crucial, involving diversification across sectors and asset classes to mitigate volatility.

This disciplined methodology allows for sustained financial independence while maximizing income opportunities over time.

Conclusion

In conclusion, the theory that a well-curated selection of dividend stocks can yield significant long-term income holds substantial merit. Historical data reveals that companies with a track record of consistent dividend payments often outperform their non-dividend-paying counterparts during market downturns. By combining these reliable income sources with growth-oriented investments, investors can enhance portfolio resilience. Ultimately, a disciplined approach to diversification and risk management is critical in capitalizing on the potential of these must-have stocks for sustainable financial success.