8594483006: Maximizing Profits in a Volatile Market

Maximizing profits in a volatile market necessitates a nuanced understanding of market fluctuations and strategic decision-making. Investors must analyze economic indicators and market trends to navigate temporary price discrepancies effectively. Implementing robust risk management strategies and diversifying portfolios can safeguard against potential losses. Yet, the real challenge lies in identifying those fleeting opportunities that could significantly impact profit margins. What specific tactics can investors employ to turn volatility into a profitable venture?

Understanding Market Volatility and Its Impact on Investments

Although market volatility is often perceived as a source of risk, it can also present unique opportunities for savvy investors.

Understanding market fluctuations requires analyzing economic indicators and recognizing shifts in investor psychology. Effective asset allocation during turbulent times can enhance profit potential, allowing investors to capitalize on temporary price discrepancies.

Embracing this volatility can lead to strategic advantages in wealth accumulation and investment growth.

Strategic Approaches to Risk Management

Market volatility, while presenting opportunities, also necessitates robust risk management strategies to protect investments.

Effective risk assessment is crucial, enabling investors to identify potential pitfalls and adjust their strategies accordingly.

Additionally, portfolio diversification serves as a vital tool, spreading risk across various assets to mitigate losses.

Leveraging Opportunities for Profit Maximization

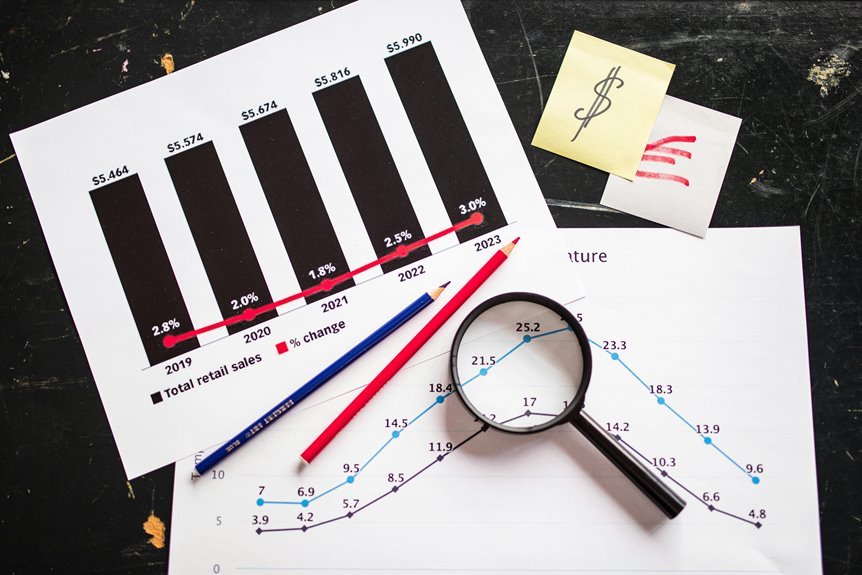

Identifying and capitalizing on market trends can significantly enhance profit margins in volatile environments.

Opportunistic investing requires acute market timing, allowing investors to seize fleeting opportunities. By analyzing price fluctuations and economic indicators, savvy investors position themselves to maximize returns.

This strategic vigilance fosters an environment where profits can flourish, as individuals leverage their insights to navigate uncertainty with confidence and agility.

Conclusion

In conclusion, navigating a volatile market demands a strategic approach to asset allocation and risk management. Investors who actively engage with market fluctuations can leverage temporary price discrepancies to enhance their profit margins. Notably, a study by Fidelity Investments revealed that during periods of high volatility, the top 20% of agile investors outperformed their peers by an average of 12%. This statistic underscores the importance of adaptability and informed decision-making in capitalizing on fleeting opportunities for sustainable wealth accumulation.